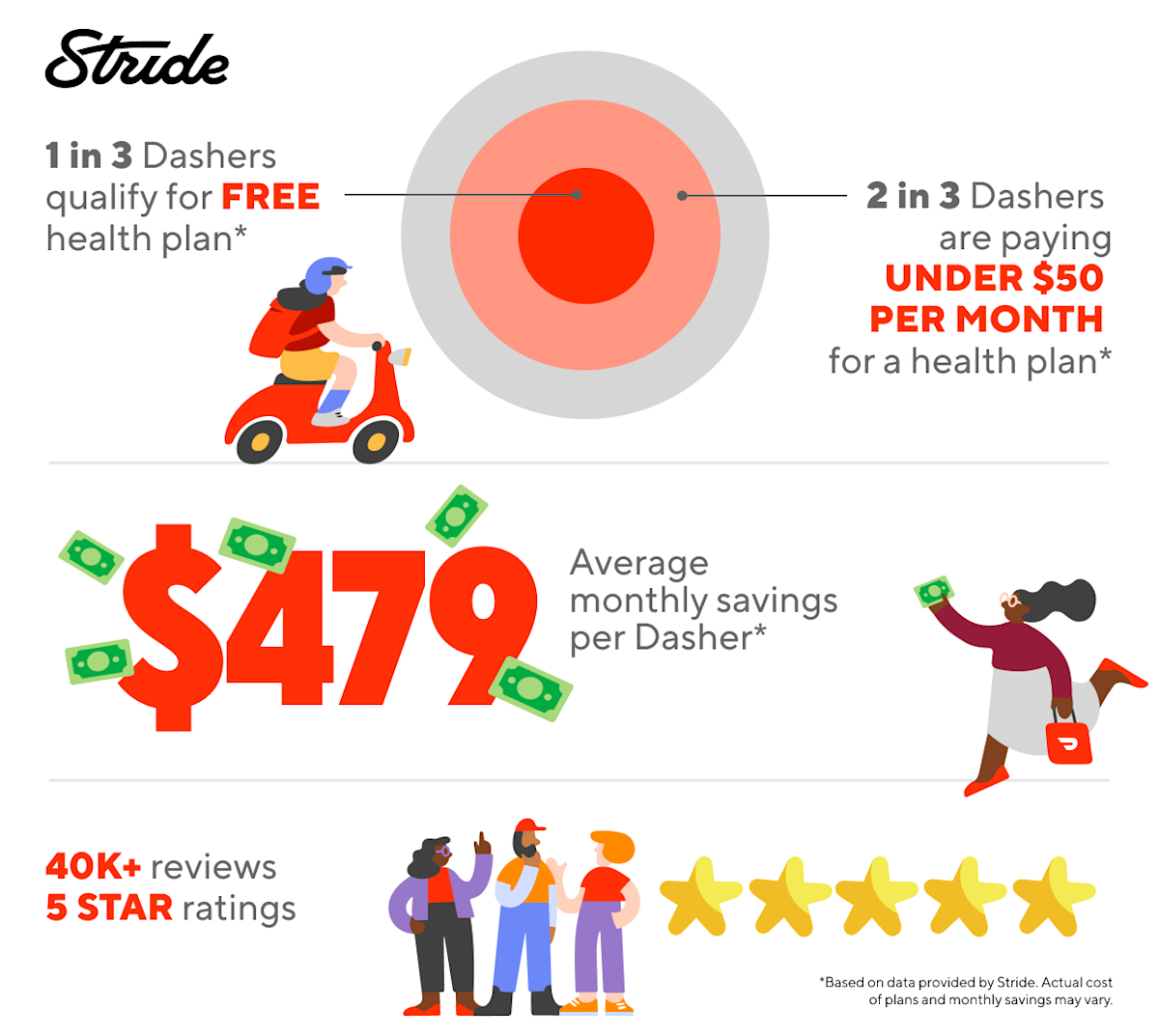

We’ve teamed up with Stride to make it easier for Dashers like you to find and save on the right health insurance for your life. Check out the details below.

Why get insured?

Health plans

Enrolling in health insurance can provide peace of mind by helping you save money on health care costs. Your insurance policy or “plan” requires a small premium paid each month, but with it, you can save big if the unexpected happens.

A doctor or hospital visit, when you’re uninsured, can lead to you paying full-price that can really add up. But thanks to the Affordable Care Act (ACA), there are more plans available than ever — and it’s possible to get coverage for a monthly premium of $1 or less depending on your ZIP code and income level.

Put your health first and get free preventive services which can help you stay healthy, avoid or delay the onset of disease or disability, and more.

Free preventative services include immunizations, diet counseling, and screenings for certain cancers, blood pressure, cholesterol, and depression — if done through a provider in your plan’s network.

Stride helps you shop for and enroll in the best coverage for your specific needs, and as an official partner of HealthCare.gov, they offer all the same plans at the same low prices.

FAQs

Can I sign up at any time of the year?

Typically, you have to wait until Open Enrollment from November 1 to January 15 each year. However, if you have a Qualifying Life Event, such as getting married, having a baby, or starting a new job, you may be able to get coverage outside of the Open Enrollment period.

Do I qualify for a government program or tax credits?

Depending on where you live, you can either fill out an application on Stride’s website to find out, or Stride will direct you to your state’s website to see if you qualify.

Can I get coverage for my family?

Yes! You can choose a plan that best meets your family’s needs.

Open Enrollment Period

You can enroll in health plans or make changes to your current plan during the Open Enrollment Period (OEP), which runs from November 1 through January 15 each year, though dates may vary by state.

You will not be able to enroll in any new plans or make changes outside of OEP unless you are eligible for Special Enrollment due to a Qualifying Life Event, such as getting married or having a baby.

Even if you’re currently covered, we recommend reviewing health insurance plans during OEP since there may be changes or updates that might work better for your budget and healthcare needs.

FAQs

Why does Open Enrollment exist?

When people with health coverage get sick or injured, insurance companies may pay out to cover some of the expenses. If Open Enrollment didn’t exist though, people may only buy health insurance when they’re already sick or injured, and in need of financial assistance.

Who is eligible to get health coverage during Open Enrollment?

Individuals between 18 and 64 years old who aren’t already covered by Medicaid, an employer, their parents, or Veterans Affairs.

Which states have extended or different enrollment windows?

Some states’ Open Enrollment Period varies:

Idaho: October 15, 2024 to December 15, 2024

California, Washington D.C., New Jersey, New York, Rhode Island: November 1, 2024 to January 31, 2025

Massachusetts: November 1, 2024 to January 23, 2025

Pennsylvania: November 1, 2024 to January 19, 2025

What if I already have health coverage?

If you’re already covered, your plan may automatically re-enroll you for next year. However, consider shopping for other plans, since they often change from year to year, including increased payments, doctors going out-of-network, or prescriptions no longer being covered.

Dental plans

Affordable dental plans (some for as little as $20/month) can provide free dental exams, cleanings and x-rays twice a year if you visit an in-network dentist. Plus, it can help pay for everything from implants and sealants to more extensive procedures like cavity fillings and root canals. These savings can add up, especially since a routine dental exam typically costs $200 out of pocket, and root canals can cost as much as $2,500!

FAQs

Can I sign up at any time of the year?

Yes, if it’s your first time signing up for a dental plan! If you’re looking to renew or replace your plan though, you typically need to wait about a month before your plan’s renewal date.

Can I get coverage for my family?

Yes, you can get it for the whole family or just those who need it.

Can I keep seeing my regular dentist if I get a plan through Stride?

You’ll need to check with your dentist to see if they’re in-network but with nationwide coverage, you can find a dentist anywhere in the US.

Vision plans

No matter your level of driving experience, nighttime driving may come with unique circumstances like difficulty reading street signs or seeing lane markings, and glaring headlights from oncoming traffic. While you can adopt tips to drive safer at night, such as regularly cleaning your windshield and using anti-glare glasses, staying on top of your vision health with annual visits to an eye doctor is important. With plans starting at around $10/month, essentials like eye exams and corrective lenses are less costly for you and your family.

FAQs

Can I sign up at any time of the year?

Yes! There are no limitations for when you can sign up.

Can I get coverage for my family?

Yes, you can get it for any of your immediate family members.

Can I keep seeing my regular eye doctor if I get a plan through Stride?

If you get insured through Stride, you’ll have access to over 84,000 eye doctors across the US. Check with your eye doctor to see if they’re in-network.